2024 Form 1041 Schedule D Form

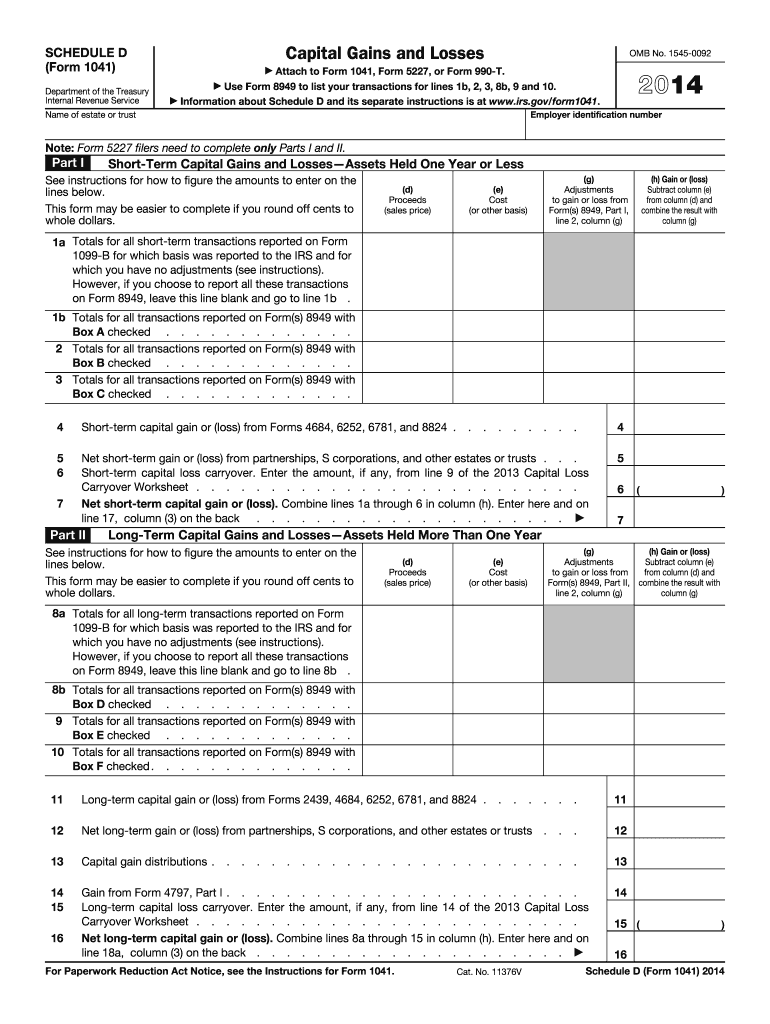

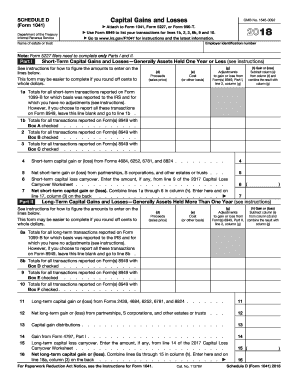

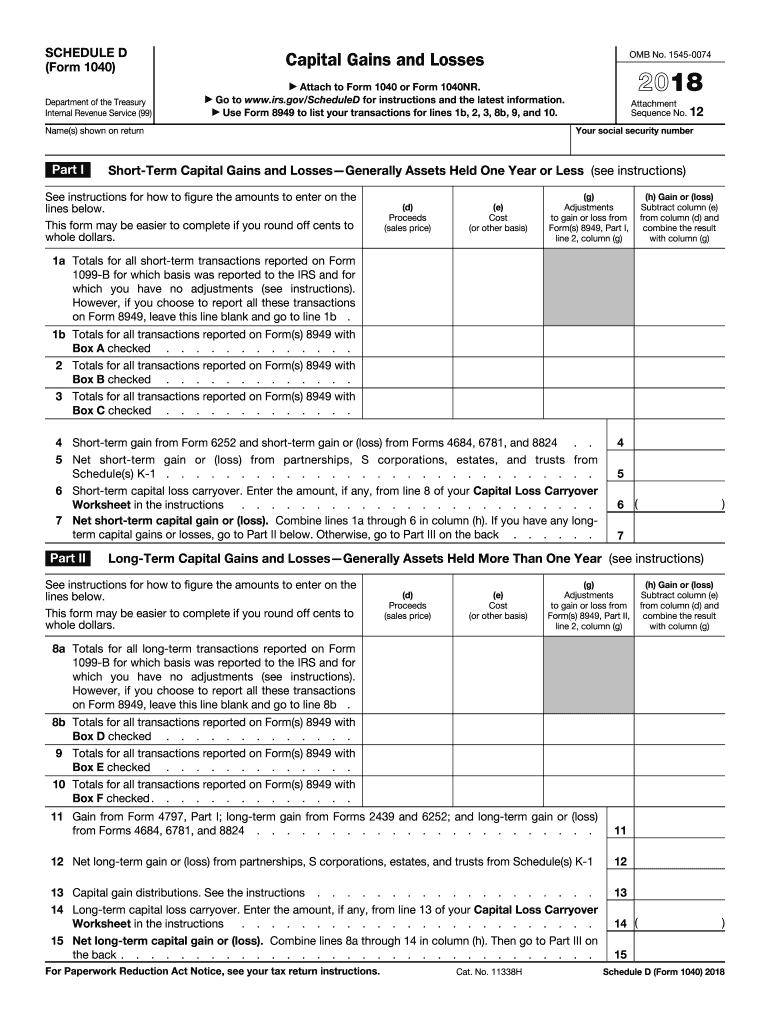

2024 Form 1041 Schedule D Form – Ownership Duration If your business profits from selling an investment owned for less than a year, it’s taxable as ordinary income by the IRS and listed on Part 1 of the Schedule D form. If the . The Schedule D form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. Most people use the Schedule D form to report .

2024 Form 1041 Schedule D Form

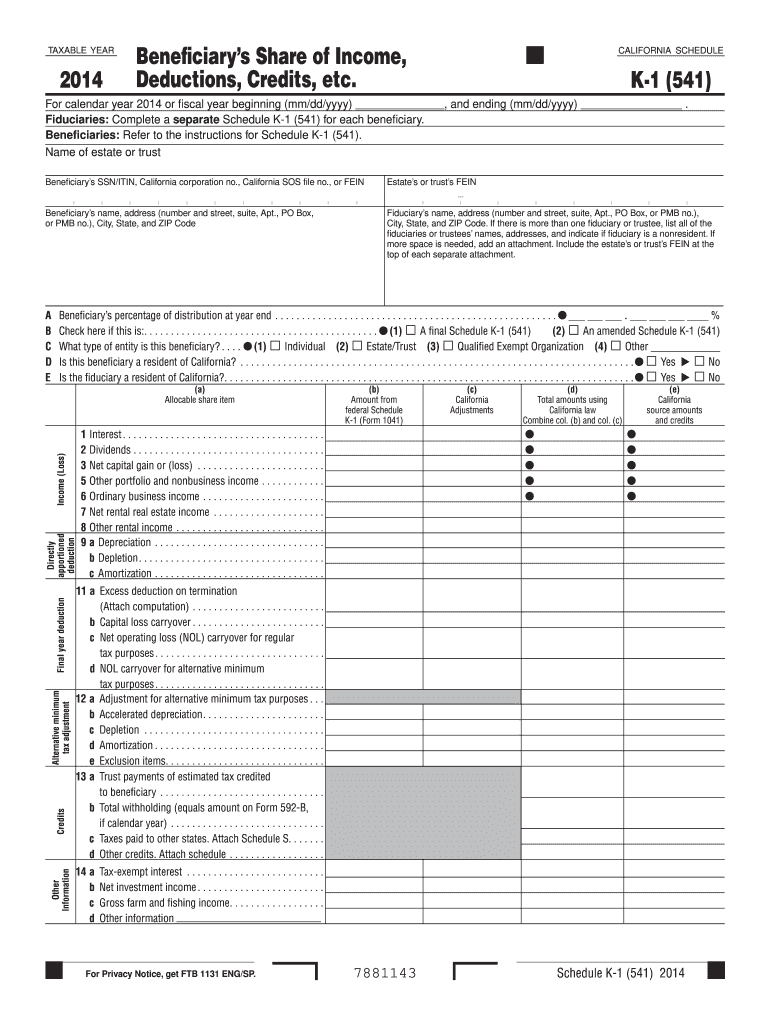

Source : form-1041-schedule-d.pdffiller.com1041K1104 Form 1041 Schedule K 1 Fiduciary Return Bond

Source : www.nelcosolutions.comIrs form 1041 schedule d: Fill out & sign online | DocHub

Source : www.dochub.com1041D120 Form 1041 Schedule D Capital Gains and Losses (Page 1

Source : www.greatland.comEditable Schedule D (1041 form) Templates | DocHub

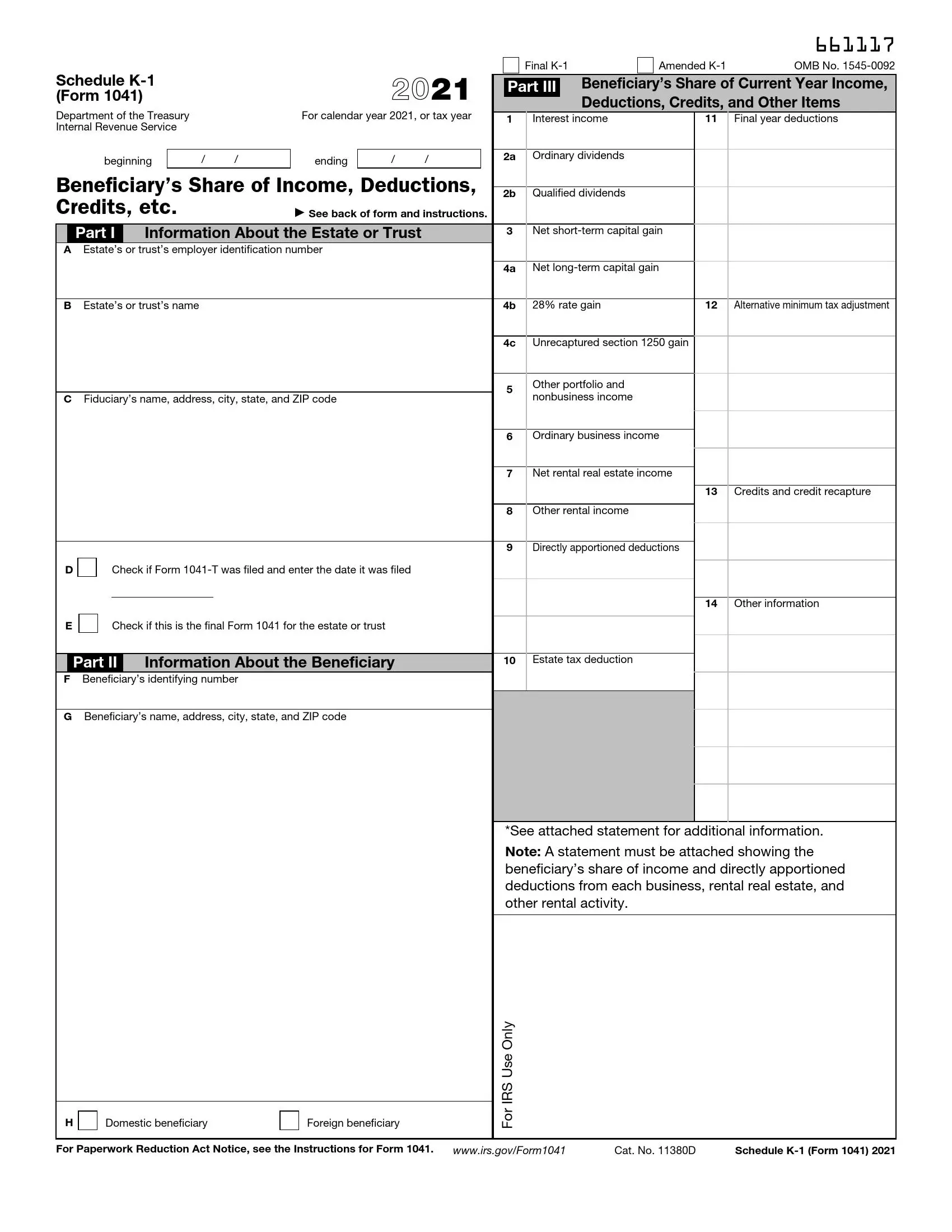

Source : www.dochub.com2023 Instructions for Schedule K 1 (Form 1041) for a Beneficiary

Source : www.irs.govK1 tax form: Fill out & sign online | DocHub

Source : www.dochub.comIRS Schedule K 1 Form 1041 ≡ Fill Out Printable PDF Forms Online

Source : formspal.com1041 schedule d: Fill out & sign online | DocHub

Source : www.dochub.comA 2024 Overview of IRS Form 1041 Schedules

Source : www.getcanopy.com2024 Form 1041 Schedule D Form Schedule D (Form 1041) 2023 Fill Online, Printable, Fillable : Buckle up and get ready to report your transactions to the Internal Revenue Service (IRS) on Schedule D and see how much tax you owe. But it’s not all bad news. If you lost money, this form . Schedule K-1 (Form 1041) is used to report a beneficiary’s If you’ve already filed your taxes using the original form, you’d then have to file an amended return with the updated information. .

]]>